AP Automation

Simplify the accounts payable process with accounts payable (AP) automation.

Get more out of your accounts payable process with automation

Get more out of your accounts payable process with automation

Businesses often receive thousands of invoices each day and processing them all requires time, effort, and resources. Accounts payable automation software helps organizations pay for invoices in an organized, timely manner for the precise amounts.

Given how critical invoice management is to fiscal health, why are so many businesses trusting this process to manual methods like spreadsheets or paper invoices?

Businesses with an automated accounts payable process save on paper, computing resources, and vendor fees from lost invoices and human error. Furthermore, IT staff and accountants save time when they no longer have to pull data together from fragmented sources.

With Concur Invoice, your organization can:

- Eliminate manual data entry by capturing invoices electronically

- Streamline workflows by automatically routing invoices and simplifying approvals with our mobile app

- Time vendor payments and more accurately forecast and manage cash flow

- Integrate with ERP and accounting systems for a more complete view of spending

- Generate reports and dashboards that provide more visibility across the entire AP process

Save time and standardize invoice data with automated invoice capture

Save time and standardize invoice data with automated invoice capture

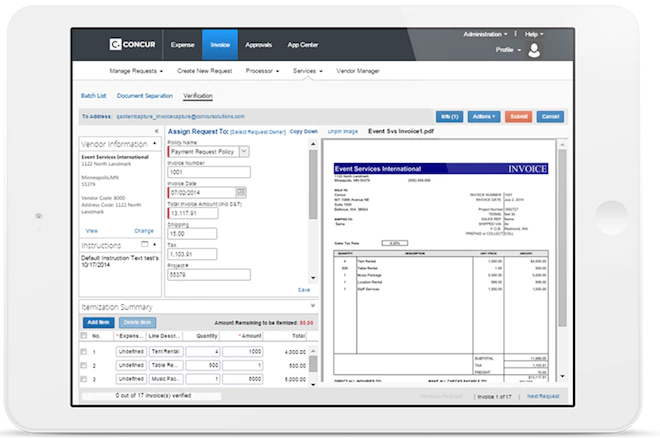

By switching from a manual invoice processing system to a fully automated, cloud-based AP process, you can cut costs, save time, and cut down on errors. Concur Invoice captures invoices electronically using optical character recognition (OCR) technology, uses two- and three-way matching to pair the PO to its associated invoice, then accurately records it to your AP system.

Accelerate invoice processing with the SAP Concur app

Accelerate invoice processing with the SAP Concur app

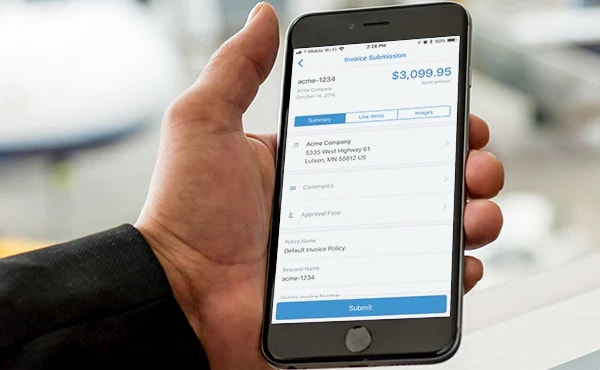

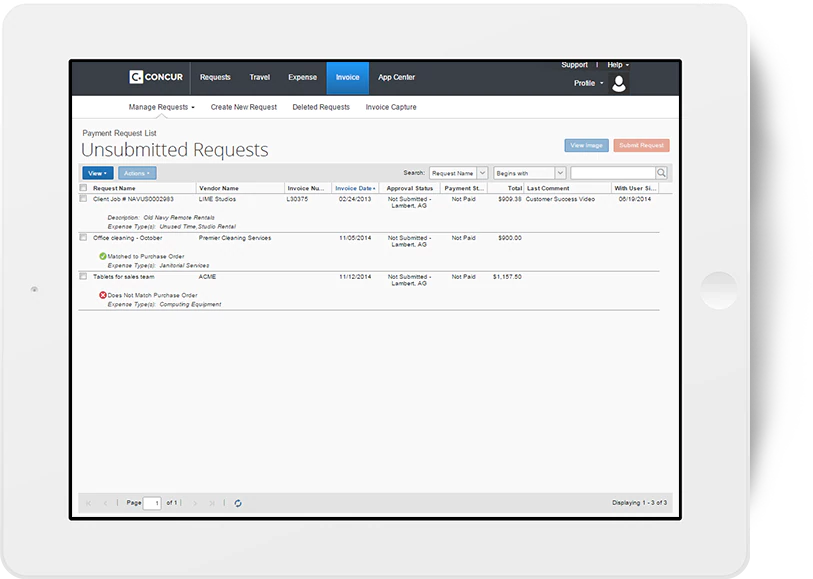

Web-based and mobile applications are easy to use and help you to streamline your AP processes, from on-the-go authorization to supplier payment. Match invoices with POs, track the progress of submitted invoices, and expedite approvals and payments – with anytime, anywhere convenience.

Time payments and control spending with powerful business intelligence tools

Time payments and control spending with powerful business intelligence tools

When you can see how employees are spending in near real time – or even before the money is spent – you can better forecast cash flow, schedule payments, and identify vendor discount opportunities. BI tools also make it easy to see when accounts were reconciled, run AP aging reports, and proactively track spend against budget.

Integrate Concur Invoice with your ERP or accounting system

Integrate Concur Invoice with your ERP or accounting system

Concur Invoice integrates your financial, HR and other business-critical systems to deliver all your data, all in one place. It also connects with solutions from other vendors across the procure-to-pay lifecycle for a truly streamlined invoice process. You can also tailor your solution to handle your company’s unique AP workflows and policies.

Read about the business value accounts payable automation

There’s no room for inefficiency, overspending, and risk in your finance workflows. Engaging with employees, customers and suppliers as well as optimizing compliance, efficiency and spend visibility are all on the ever-lengthening list of mandates. Automating accounts payable (AP) can help finance leaders meet those challenges head on. This white paper explores the costs and benefits of Concur Invoice with a focus on quantified results:

Download whitepaper

It costs AP departments with no automation and inconsistent processes four times as much to process an invoice as departments with end-to- end automation and consistent processes – $6.30 versus $1.45 per invoice.

How Automation Reduces the Cost of Invoice Processing

Institute of Finance & Management

Contact us about a better way to handle expense, travel, and invoice management

Complete the form to have a sales representative contact you, or call +1 (888) 883-8411 today.

Thank you for contacting us about a better way to manage travel, expenses or invoices.

We have received your request for information, and we will be in touch with you soon.

Improve your AP process with an invoice policy

5 tips for reviewing an existing policy or writing a best practice invoice policy for the first time

Keep it simple

The easier an invoice policy is to understand, the easier it is for your employees to follow and for management to enforce. Use simple language that doesn’t invite misinterpretation and don’t make your policy unnecessarily wordy.

Create as a team

Employees who help build a policy are simply more likely to follow it! Ask team members from different departments to participate in creating your invoice policy to ensure it addresses the pain points faced company-wide.

Reference other policies

Do you already have other policies in place that may affect the management or approval of invoices? Consider referencing such policies as Document Retention, Delegation of Authority, or Segregation of Duties.

Explain the benefits

Whether your reasons for creating a policy are minimizing late vendor charges, managing exceptions consistently or ensuring the company is always audit-ready, explain these reasons in writing to maximize employee buy-in.

Enforce with consistency

When you apply any policy fairly across all employees, they’re more likely to embrace it. Ensure that every employee, regardless of position or tenure, respects the policy and keep a record of all actions taken.

To get more tips into invoice policy creation, and a policy template, read the paper, “Taking the Pain Out of Accounts Payable Management”.

The easier a policy is to understand, the easier it is for your employees to follow and enforce.”

Proformative,

a division of Argyle