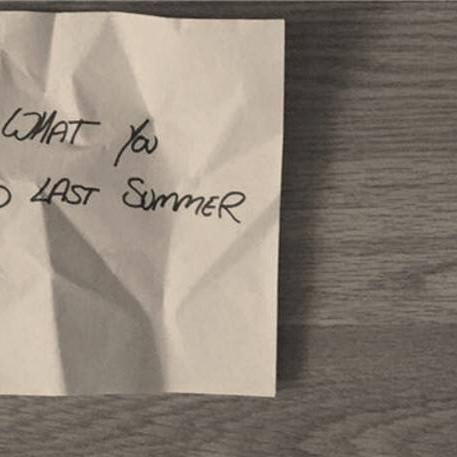

We know what you expensed last summer…

...at least we do if you’re one of our customers. Let’s set the scene:

After a troublesome business trip, four colleagues - who are feeling a bit miffed - decide to exaggerate their expense claims. After submitting their expenses, they receive anonymous messages from a Concur auditor. They start to feel guilty and soon they are desperate to come clean. Before their fraudulent expenses are exposed any further, they withdraw their claims.

Okay, falsified expense claims may not be as scary as a blockbuster movie. But they can be just as devastating to businesses. If exaggerated expenses get approved, this could cost your company thousands and put your VAT position at risk.

You wouldn’t believe what some people try to expense

We have helped our clients catch their fair share of outlandish expense claims during the audit process. Some people just don’t know their travel and expense policy – hands up if you can recite yours? Others view expense reimbursement as a second pay day and some just do it because they know they can.

Some of the things people tried to expense include:

- Monthly mortgage payments

- Extravagant weekend hotel stays

- Edited taxi receipts from $11 to $111

- Doggy day care

Only 1% of expense claims get rejected by managers but 1 in 5 employees think it is okay to exaggerate their expenses

Not all exaggerated claims are extravagant

What about the lesser policy violations? For example, your company policy might allow a $30 spend for dinner. But if an employee purchased a $4 meal-deal, a DVD and some flowers for their significant other for $22, would your internal audit process be able to catch that behaviour?

Whilst this may be a small amount in the grand scheme of things, if lots of employees are doing it, it soon adds up and where will it end? This could lead to a flood of out of policy spend just because it is under the daily budget.

So what can you do about it?

If you’re a Concur Expense customer, we offer an unbiased audit service to check up to 100% of all claims and receipts that get submitted. So whether you’re the CEO or a junior employee, everyone will be treated the same helping improve compliance, save time and most of all, money.

If you’re not using Concur Audit, how do you know what your employees expensed last summer?